Ready to start your Bitcoin journey? Sign up for OKX, Binance, or Bitget today and take your first step into the world of cryptocurrency!

OKX:https://okx.com/join/8798539

Binance:https://accounts.binance.com/register?ref=1031203493

It would be hard to miss the remarkable surge in artificial intelligence (AI) recently. The buzz around OpenAI’s ChatGPT, which quickly captivated global attention, alongside AI’s impact on art and the automation of various sectors, firmly establishes AI’s enduring presence. Predictably, the cryptocurrency sphere soon recognized its significance.

This recognition has led to the emergence of AI crypto projects—a fusion where the power of artificial intelligence meets the decentralized nature of blockchain technology.

But why is this combination important? AI contributes its inherent intelligence and automation capabilities, whereas blockchain introduces attributes like security, immutability, and decentralization. Together, they are giving rise to innovative and practical projects that have the potential to fundamentally reshape our interaction with data, finance, and technology.

This analysis offers an exploration of the developing AI crypto landscape. We will examine the points of intersection between these technologies, showcase some notable projects within this domain, and identify the distinguishing factors that set them apart from the multitude of AI-focused cryptocurrencies.

Whether it involves amplifying the capabilities of decentralized applications through AI or leveraging blockchain to enhance the transparency and democratic nature of AI operations, these projects are demonstrating tangible applications, moving beyond mere speculative interest in the AI trend. So, without further delay, let’s delve into the promising future that lies at the intersection of AI and crypto!

The Convergence of AI and Crypto

The notion of integrating AI with blockchain is not new, but it is within the last few years that a true convergence of these technologies has begun to materialize. Blockchain’s journey commenced with Bitcoin in 2009, introducing the concept of a decentralized and transparent digital ledger. Over the subsequent decade, blockchain has evolved to underpin applications within decentralized finance (DeFi), supply chain management, payment systems, and much more.

AI, conversely, has been under development for many decades. Its recent leap in capability—fueled by advancements in machine learning and computational power—has propelled it into mainstream awareness. Innovations such as OpenAI’s ChatGPT have illustrated AI’s capacity to revolutionize various industries.

How AI and Crypto Collaborate

Fundamentally, AI and blockchain address distinct challenges, but their combination yields unique synergistic effects:

- Trust and Clarity: AI systems often function as “black boxes,” making their decision-making processes opaque. Blockchain addresses this by recording AI actions on an unalterable ledger, ensuring both clarity and accountability.

- Data Control and Monetization: AI heavily relies on data, yet data ownership remains a significant concern. Blockchain empowers users with control over their data, enabling them to monetize it and dictate its usage in AI training.

- Decentralization: Most AI development is centralized, dominated by large technology corporations. Blockchain facilitates decentralized platforms, democratizing AI and ensuring its benefits are more widely accessible.

While the integration of AI and blockchain is still in its preliminary phases, the potential for groundbreaking innovation is immense. However, with a multitude of AI crypto projects now in existence, discerning the genuinely promising ventures from those driven by hype can be difficult. The following section outlines strategies for effectively navigating this emerging space.

Our Methodology

Let’s emphasize a critical point: the quality among AI crypto projects is not uniform. In a market saturated with ambitious promises and trendy jargon, distinguishing authentic innovation from superficial excitement can be overwhelming. Therefore, our methodology concentrates on identifying projects that genuinely excel in their technology, utility, and long-term viability. Here’s our approach:

- Technological Evaluation: We meticulously examine the underlying technology of each project. Simply labeling a project “AI-powered” is insufficient; we assess the meaningfulness and impact of the AI and blockchain integration. For example, is AI being applied to solve real-world issues? Does the blockchain enhance the AI’s functionality, security, or accessibility?

- Use Cases: A robust project doesn’t develop technology for its own sake; it creates solutions that are relevant. We evaluate the target industries and applications of each project. Are they making significant strides in areas like data analysis, autonomous trading, or decentralized AI services? If so, how effectively are they achieving these objectives?

- Tokenomics: Tokenomics forms the core structure of any cryptocurrency project, and AI cryptos are no exception. We analyze the token’s supply, its utility within the ecosystem, and any mechanisms for staking or earning. A strong correlation between the tokenomics and the project’s overarching goals is essential.

- Market Credibility: Projects demonstrating real-world application and long-term potential often showcase their legitimacy through consistent market performance. Market capitalization serves as a key indicator, reflecting not just investor interest but also the project’s ability to deliver over time. Projects with established market caps tend to have staying power—a sign that they are more than just fleeting trends and are rooted in practical applications. While a high market cap alone doesn’t guarantee success, it is frequently a strong indication of a project’s credibility and resilience within a competitive landscape.

Top AI Crypto Projects in 2025

Before exploring each project individually, here’s a table summarizing them:

| Project Name | Token Symbol | Main Utility |

|---|---|---|

| NEAR Protocol | NEAR | A layer-1 blockchain facilitating scalable, cross-chain functionality and User-Owned AI tools. |

| Virtuals Protocol | VIRTUAL | Platform for creating, tokenizing, and trading AI-powered virtual agents for diverse applications. |

| Bittensor | TAO | Decentralized network providing infrastructure for AI computation and collaboration. |

| Artificial Superintelligence Alliance (ASI) | FET | Unified platform offering decentralized AI services, data sharing, and autonomous operations. |

| The Graph | GRT | Decentralized indexing and querying protocol for blockchain data and AI applications. |

| AIOZ Network | AIOZ | Decentralized infrastructure for AI computation, storage, and content delivery in Web3. |

Now, let’s examine these projects in greater detail.

Near Protocol

Near Protocol is a layer-1 blockchain engineered to enhance user-friendliness, scalability, and interoperability across different blockchains. Its aim is to function as a universal access point for blockchain ecosystems, enabling seamless interactions between various networks. Near is also making significant progress in decentralized AI through its User-Owned AI initiative, which focuses on democratizing access to AI tools and applications.

Technology and AI Integration

Near Protocol combines cutting-edge blockchain technology with a focus on practical applications, including a strong emphasis on decentralized AI. Its User-Owned AI approach seeks to grant users greater control over AI tools and applications, challenging the dominance of centralized AI models held by major technology firms. Key technological advancements include:

- Chain Signature Technology: Allows users to manage assets across multiple blockchains from a single wallet, eliminating the need to switch between platforms and simplifying interactions within multi-chain environments.

- Stateless Validation: Enhances scalability by reducing the data required for transaction verification, making it more efficient and accessible for individuals to operate validator nodes.

- AI Lab and Research: The Near.AI lab, led by co-founder Illia Polosukhin, is dedicated to developing decentralized AI tools and integrating them into Web3 ecosystems, paving the way for broader and more democratic access to AI.

Key Use Cases

Near Protocol’s infrastructure supports a wide array of applications:

- Decentralized Finance (DeFi): DApps such as AllStake utilize Near’s cross-chain capabilities for liquid staking across multiple blockchains.

- Artificial Intelligence (AI): Near’s User-Owned AI initiative is focused on building a decentralized AI ecosystem. By empowering users with ownership and control over AI tools, Near is addressing industries like healthcare, where privacy-preserving AI can improve diagnostics, and supply chain management, where AI-driven data analysis can optimize logistics.

- Cross-Chain Wallets: Through its chain signature technology, Near facilitates smooth cross-chain transactions, delivering a user experience comparable to centralized exchanges while maintaining decentralization.

Tokenomics

The NEAR token has a total supply of 1 billion with an annual inflation rate of 5% to support the network and provides the following utilities:

- Transaction Fees: Facilitates low-cost transactions and smart contract execution.

- Staking and Governance: Token holders can stake NEAR to contribute to network security and participate in governance voting.

- Developer Incentives: Provides rewards for projects that contribute to Near’s ecosystem.

A deflationary mechanism burns 70% of transaction fees, ensuring the long-term sustainability of the token while encouraging active participation within the network.

Pros and Cons

Pros:

- AI Integration: Strong focus on the development of decentralized AI.

- Cross-Chain Interoperability: Chain signatures simplify interactions across multiple blockchains.

- Established Presence: High market capitalization and significant real-world adoption demonstrate its credibility and utility within the blockchain space.

Cons:

- Competition: Faces significant competition from Ethereum, Solana, and other established Layer-1 blockchains.

- Adoption Gaps: Many AI-focused applications are still in the development phase.

- Resource Allocation: Ambitious goals across different niches risk diluting resources.

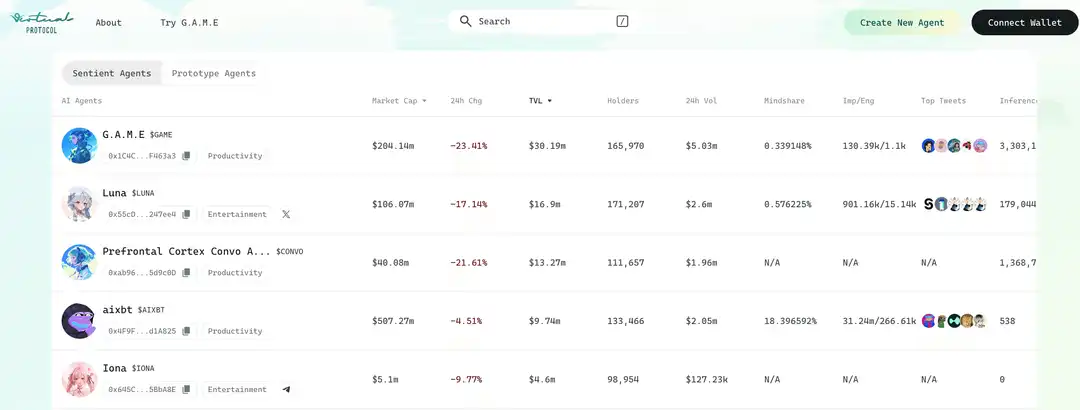

Virtuals Protocol

Virtuals Protocol is a decentralized platform launched in 2024 that combines AI and blockchain technology to enable the creation, tokenization, and monetization of AI agents. Built on the Base rollup, it transforms AI agents into tradable, revenue-generating assets across sectors including gaming, entertainment, and virtual interactions.

Technology and Core Components

Virtuals Protocol utilizes advanced AI and blockchain technologies to establish an efficient ecosystem for the development and deployment of AI agents:

- AI Agent Tokenization: The protocol allows AI agents to be represented as ERC-20 tokens, paired with the native VIRTUAL token in liquidity pools. This facilitates seamless trading and integration across various platforms.

- Generative Autonomous Multimodal Entities (G.A.M.E) Framework: This framework simplifies the creation of interactive AI agents with decision-making and communication capabilities, supporting complex applications.

- Blockchain Integration: Utilizing the Base rollup, the protocol ensures decentralized governance, transparent value distribution, and efficient management of AI agents and their associated revenue streams.

Key Use Cases

Virtuals Protocol’s applications span multiple AI-driven industries:

- Gaming and Entertainment: Enables developers to integrate AI-powered virtual characters into games and virtual environments.

- AI Agent Marketplace: Functions as a decentralized marketplace where users can purchase, sell, or deploy AI agents for various applications.

- Co-Owned AI Assets: Allows for shared ownership and governance of AI agents, enabling collective decision-making and revenue sharing among holders.

Tokenomics

The VIRTUAL token has a maximum supply of 1 Billion and serves as the ecosystem’s core utility and governance token:

- Utility: Supports transaction fees, staking, governance participation, and serves as a pairing token for trading AI agent tokens.

- Supply: The token is paired with individual AI tokens in liquidity pools, incentivizing trading and participation within the ecosystem.

Pros and Cons

Pros:

- Innovative AI Integration: Combines blockchain and AI to tokenize and monetize virtual agents.

- Rapid Market Traction: Demonstrates significant adoption and growth since its launch.

- Developer-Friendly Tools: Offers frameworks like G.A.M.E to streamline the development of AI agents.

Cons:

- Market Volatility: Subject to the same price fluctuations as other cryptocurrency projects.

- New Narrative: Virtuals operates within the relatively new AI agent narrative, which could lose momentum if interest wanes.

Bittensor

Bittensor has rapidly gained prominence within the AI crypto niche. Despite its relatively recent emergence and the complexities surrounding its functionality, it is already among the largest AI projects in the space, positioning itself as a decentralized hub for AI computing power.

Technology and Unique Consensus Mechanism

Bittensor operates as a blockchain-based platform for decentralized AI computation, where miners provide processing power, and validators ensure its efficient allocation across various AI networks, known as subnets. Its technological foundation is built on Substrate, the same framework behind Polkadot, but it distinguishes itself with its unique Yuma Consensus Mechanism:

- Yuma Consensus: Named after the pseudonymous author of Bittensor’s white paper, this mechanism rewards miners and validators based on their performance, ensuring optimal distribution of resources across subnets.

- Subnets: Each subnet caters to a specific AI use case, ranging from text prompts to image generation, with Bittensor currently supporting over 50 subnets.

Key Use Cases

Bittensor’s AI-powered ecosystem supports a variety of applications:

- Decentralized AI Computing: Provides infrastructure for AI tasks, enabling researchers and developers to access scalable computing power without reliance on centralized providers.

- Subnet Functionality: Each subnet caters to specific AI tasks, such as text-based AI models similar to ChatGPT and image generation systems.

Despite its potential, the platform has yet to demonstrate significant real-world adoption, with only a few functioning applications currently live.

Tokenomics

The TAO coin powers Bittensor’s ecosystem and serves several purposes:

- Staking and Rewards: Validators stake TAO to secure the network and earn up to 18% annual rewards, while miners receive emissions for providing computational resources.

- Fee Payments and Governance: TAO is used for transaction fees and will eventually enable on-chain governance.

With a total supply capped at 21 million, TAO’s aggressive early inflation rate—7,200 coins minted daily—creates substantial supply-side pressure.

Pros and Cons

Pros:

- Unique Consensus Mechanism: Incentivizes the efficient use of resources across subnets.

- Institutional Backing: Strong interest from major crypto venture capital firms and investors.

Cons:

- Limited Adoption: Few working applications and low user engagement.

- Complexity: Difficult for the average user to understand or utilize effectively.

- Inflationary Pressure: High daily emissions could hinder price appreciation.

Artificial Superintelligence Alliance (ASI)

The Artificial Superintelligence Alliance (ASI) was formed in 2024 through the merger of three leading decentralized AI platforms: Fetch.ai, SingularityNET, and Ocean Protocol. By combining their expertise, ASI aims to provide a unified platform for decentralized AI services, autonomous operations, and secure data sharing.

Technology and Core Components

ASI integrates the strengths of its founding platforms to create a comprehensive decentralized ecosystem:

- Autonomous AI Agents: Leveraging Fetch.ai’s technology, ASI deploys independent agents capable of executing tasks like logistics optimization, resource allocation, and real-time decision-making without human intervention.

- Decentralized AI Network: Built on SingularityNET’s infrastructure, ASI provides developers with tools to run AI applications on a decentralized network, ensuring transparency and accessibility.

- Data Sharing and Monetization: Ocean Protocol’s marketplace enables secure data sharing and monetization, allowing data providers to maintain control while supporting AI training and applications.

Key Use Cases

- Decentralized AI Services: Provides scalable AI solutions for industries like healthcare, finance, and logistics without relying on centralized providers.

- Data Marketplace: Facilitates secure data sharing and monetization, vital for AI model training and other applications.

- Autonomous Operations: Employs AI agents to automate processes such as market trading, resource management, and smart contract execution.

Tokenomics

The Artificial Superintelligence Alliance (ASI) employs a unified token system that powers its ecosystem with the following features:

- Total Supply: Approximately 2.72 billion ASI tokens, consolidating the supply from the merger of Fetch.ai, SingularityNET, and Ocean Protocol.

- Utility: The ASI token serves multiple purposes, including transaction fees, staking to secure the network, governance participation, and incentivizing ecosystem contributors.

Pros and Cons

Pros:

- Unified Ecosystem: Combines Fetch.ai’s agents, SingularityNET’s AI network, and Ocean Protocol’s data marketplace into a single platform.

- Diverse Applications: Supports AI services, data monetization, and autonomous operations across multiple industries.

Cons:

- Integration Challenges: Merging three platforms with distinct technologies poses technical and operational hurdles.

- Market Competition: Faces challenges from established centralized AI providers and other decentralized AI platforms.

- Broad Focus: Targeting numerous AI use cases may stretch resources thin, potentially delivering less impactful services compared to competitors with a narrower, specialized focus.

The Graph

The Graph is a decentralized protocol designed to index and query blockchain data, creating efficient access for decentralized applications (dApps). Known as the “Google of blockchains,” it addresses the challenges of retrieving and organizing blockchain data by creating subgraphs—open APIs that developers and users can query seamlessly. Built to support the needs of both Web3 and emerging AI applications, The Graph is revolutionizing data accessibility across decentralized ecosystems.

Technology and AI Integration

The Graph combines decentralized blockchain indexing with AI-driven optimization tools to enhance its efficiency and scalability. It enables dApps and AI systems to retrieve complex, real-time data without reliance on centralized services, ensuring transparency and trust in data processing. Key aspects include:

- Subgraph Indexing: Developers create subgraphs that organize blockchain data into accessible APIs, streamlining how dApps retrieve information for smart contracts, DeFi analytics, and more.

- Decentralized Querying: Indexers, Curators, and Delegators work collaboratively within the protocol to maintain the integrity and accuracy of indexed data, rewarding contributors with the native GRT token.

- AI-Enhanced Applications: The Graph’s structured and indexed data supports AI model training and deployment, particularly for tasks like predictive analytics, risk modeling, and real-time decision-making in decentralized ecosystems.

Key Use Cases

- Decentralized Finance (DeFi): Provides real-time data on token prices, liquidity, and transaction histories, enabling developers to build efficient DeFi applications.

- NFT Marketplaces: Indexes metadata and ownership records, ensuring seamless user experiences for buyers and sellers.

- AI-Powered dApps: Supplies structured blockchain data for AI tools, enabling advanced applications in predictive modeling and analytics.

Tokenomics

The GRT token powers The Graph’s ecosystem, incentivizing participation and maintaining network sustainability:

- Total Supply: Initially set at 10 billion GRT, with a 3% annual inflation rate for indexing rewards.

- Utility: Used for staking, query fees, and signaling high-value subgraphs.

- Burning Mechanisms: A portion of query fees and penalties is burned, countering inflation.

Pros and Cons

Pros:

- Essential Infrastructure: Serves as a critical data backbone for Web3 and AI applications.

- Decentralized Framework: Removes reliance on centralized services, enhancing trust and transparency.

- AI Optimization: Uses AI tools to improve efficiency and cost-effectiveness.

Cons:

- Competition: Faces challenges from centralized data providers and other decentralized solutions.

- Adoption Reliance: Success depends on widespread adoption among developers and dApps.

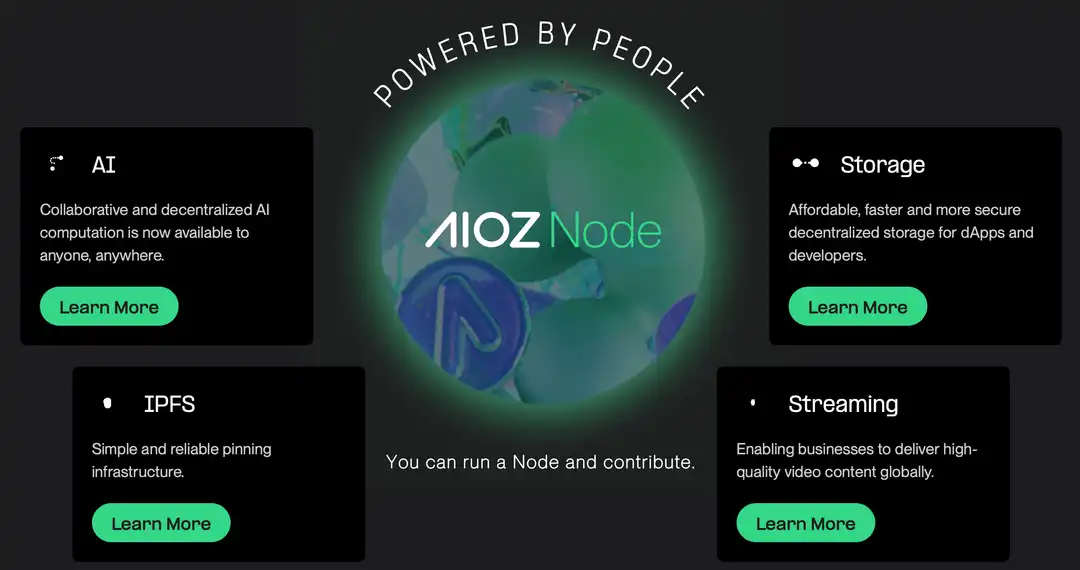

AIOZ Network

AIOZ Network is built on a Layer-1 blockchain compatible with both Ethereum and Cosmos ecosystems, AIOZ Network integrates decentralized storage, AI computation, and content delivery. Its decentralized Content Delivery Network (dCDN) leverages peer-to-peer nodes to enhance streaming, reduce latency, and improve scalability, while AIOZ Web3 AI supports AI model training and execution. These features position AIOZ as a versatile platform for decentralized solutions in media, storage, and AI applications.

Technology and Core Components

AIOZ Network provides a robust infrastructure for Web3 applications, featuring:

- Decentralized Storage: AIOZ Web3 Storage (W3S) uses a peer-to-peer node system for scalable and secure storage with S3 compatibility for seamless integration with existing cloud services.

- AI Computation: AIOZ W3AI supports decentralized AI tasks, including local AI model execution, secure data sharing, and a decentralized AI marketplace.

- Live Streaming: AIOZ W3Stream delivers low-latency, decentralized video streaming for media platforms, live events, and gaming.

- Blockchain Technology: Built on Cosmos and EVM-compatible infrastructure, AIOZ leverages Tendermint core and dBFT consensus for scalability and interoperability with other blockchains.

Key Use Cases

- Content Delivery and Streaming: AIOZ’s decentralized Content Delivery Network (dCDN) powers seamless streaming for media, education, and gaming platforms.

- AI-Powered Applications: AIOZ W3AI enables industries to deploy AI capabilities with secure, decentralized computation.

- Decentralized Storage: AIOZ W3S provides scalable storage solutions for Web3 applications, including NFT marketplaces and healthcare data.

Tokenomics

The AIOZ token has a current total supply of 1.08 billion tokens and operates without a fixed cap on its maximum supply. It serves the following purposes:

- Transaction Fees and Rewards: Facilitates payments for services and rewards node operators for their contributions.

- Staking: Secures the network while providing participants with staking rewards.

- Ecosystem Growth: Funds development initiatives and promotes platform adoption.

AIOZ has updated its tokenomics with a controlled inflation model, gradually reducing inflation to 5% by 2026.

Pros and Cons

Pros:

- Comprehensive Infrastructure: Combines storage, AI computation, and streaming in a unified platform.

- Interoperability: Integrates with Ethereum, Cosmos, and other blockchain ecosystems.

Cons:

- Adoption Challenges: Limited current adoption compared to established players.

- Broad Focus: Diverse use cases may dilute efforts and slow progress in individual areas.

- Competition: Faces strong rivals in storage, AI, and streaming sectors.

AI Crypto Projects by Specific Categories

Below, we’ve categorized notable AI-crypto projects based on their primary use cases.

Data Analysis and Prediction

These projects utilize AI and blockchain to analyse complex datasets, providing insights for various industries.

- The Graph (GRT): Known as the “Google of blockchains,” The Graph indexes blockchain data, enabling developers to query and access information for building decentralised applications.

- Fetch.ai (ASI): Fetch.ai employs autonomous AI agents to streamline data processes, optimizing supply chains, predicting trends, and enhancing business operations.

Autonomous Trading

These platforms develop AI-driven trading algorithms and automated strategies to simplify market decisions.

- Numerai (NMR): Numerai is a decentralized hedge fund that utilizes AI models contributed by data scientists to optimize trading strategies, rewarding accurate predictions.

- Virtuals Protocol (VIRTUAL): Virtuals Protocol enables the creation of AI agents that can autonomously execute trades on behalf of users.

Decentralized AI Services

These projects aim to democratize AI by decentralizing its development and applications, keeping control in the hands of users.

- SingularityNET (ASI): A platform where developers can create, share, and monetize AI services, ensuring decentralized access without single-entity control.

- NEAR Protocol (NEAR): Through its User-Owned AI initiative, NEAR provides infrastructure for decentralized AI, enabling users to deploy AI solutions while retaining ownership and control.

Industry-Specific Applications

These projects apply AI to address challenges in specific industries such as media, cloud computing, and finance.

- AIOZ Network (AIOZ): AIOZ Network leverages its decentralized W3AI platform and extensive edge nodes to deliver scalable AI computation and a marketplace for AI model monetization.

- Akash Network (AKT): Akash offers decentralized cloud computing resources for AI workloads, meeting the growing demand for computational power in AI development.

How to Evaluate AI Crypto Projects for Investment?

Investing in AI-focused cryptocurrencies demands a strategic and analytical approach to distinguish genuine innovation from speculative hype. Here are the key factors to consider:

- Technology and Innovation: The backbone of any AI crypto project lies in its technology. Assess whether the project’s AI integration addresses practical issues, such as improving data analysis, enabling decentralized AI computation, or automating tasks. Technological uniqueness is crucial—projects offering innovative and groundbreaking solutions are better positioned for long-term success.

- Team and Partnerships: A project’s success is often tied to its team and partnerships. Investigate the credentials of the founders and developers—are they experts in AI, blockchain, or both? Partnerships with reputable institutions, established blockchain networks, or backing from prominent VCs indicate legitimacy and growth potential.

- Tokenomics and Market Position: Examine the project’s tokenomics carefully. Is the token integral to the ecosystem, or does it feel secondary? Review aspects like supply, inflation rates, staking rewards, and mechanisms that promote long-term holding. Market position also matters—projects with moderate market caps often provide better ROI but carry higher risk, while those with higher market caps may offer lower ROI but greater certainty in achieving it.

- Community and Developer Support: Active community engagement and a robust developer ecosystem are strong indicators of a project’s ability to adapt and evolve. Look for transparency in communications, frequent updates, and active development through platforms like GitHub to gauge how the project values its community.

- Competition: The AI crypto space is fiercely competitive. Evaluate how the project differentiates itself—does it solve unique problems or bring superior technology? Projects with niche use cases or those that integrate seamlessly into existing blockchain ecosystems often have a competitive edge over those chasing the same use cases as their competitors.

Tip for Simplified Research: For an easier way to compare AI crypto projects, use the AI categories on and CoinGecko to explore the full range of projects in the AI niche. We also have a detailed video on the Coin Bureau YouTube channel that dives into the specifics of how to conduct your own research.

Potential Risks and Considerations

While the AI crypto projects we’ve covered are among the most credible in the industry, it’s crucial to recognize that they operate in a highly competitive and evolving space. Here are some overarching risks and challenges associated with the AI crypto niche:

- Volatility and Market Risks: The crypto market’s inherent volatility is amplified for AI-focused projects. Their association with the trending AI sector can attract speculative hype, leading to inflated valuations that may not reflect the project’s actual progress or adoption. Moreover, these projects are exposed to market fluctuations influenced by broader trends in both the crypto and AI industries, making them particularly susceptible to swings in investor sentiment.

- Regulatory Challenges: AI and blockchain are two of the most scrutinized technologies globally, and their intersection is likely to face even greater regulatory attention. Governments are still navigating how to regulate AI, particularly around data privacy, intellectual property, and ethical concerns. Meanwhile, blockchain has just recently started getting its own regulatory framework in jurisdictions like the EU and US. Combined, AI cryptocurrencies could face challenges from both angles.

- Technological Risks: The promise of AI is vast, but its long-term impact remains uncertain. Decentralized AI projects are competing against centralized companies that benefit from faster iteration and deployment capabilities. Unlike decentralized systems that require consensus and community involvement, centralized structures can adapt swiftly, giving them a significant edge in a fast-paced niche like AI.

- Additionally, if AI’s anticipated transformative impact doesn’t materialize or falls short of expectations, projects heavily focused on AI could lose relevance, struggling to justify their positioning in both the crypto and AI spaces.

Closing Thoughts

With dozens of AI-focused crypto projects entering the market, each claiming to outdo the last, it’s reminiscent of the early days of Bitcoin’s rise when everyone was searching for the “next big thing.”

As interest in the metaverse fades, AI and machine learning have taken center stage. ChatGPT alone garnered over 100 million users in its first month—a milestone unmatched by any other technology. Public opinion remains divided: some fear AI’s potential to disrupt jobs, while others are eager to embrace the countless opportunities AI could unlock.

In conclusion, the fusion of AI and cryptocurrencies presents a compelling and innovative frontier. While it remains to be seen if the AI hype will fade, over a year after ChatGPT’s debut, both traditional AI companies and crypto AI projects continue to hold the public’s attention. This enduring interest suggests that AI might be here to stay.

Ready to start your Bitcoin journey? Sign up for OKX, Binance, or Bitget today and take your first step into the world of cryptocurrency!