Ready to start your Bitcoin journey? Sign up for OKX, Binance, or Bitget today and take your first step into the world of cryptocurrency!

OKX:https://okx.com/join/8798539

Binance:https://accounts.binance.com/register?ref=1031203493

Welcome to another promising year for digital currencies! As we move into 2025, market optimism is strong, fueled by tangible advancements and groundbreaking innovations. In this analysis, we’ve assembled a review of the primary crypto narratives for the upcoming year, combining personal observations with research from prominent voices in the sector, such as Bitwise, VanEck, Ark Invest, a16z, and others.

Let’s delve into the trends shaping the future of digital assets.

Bitcoin Gaining Economic Footing

Throughout 2024, the marketplace dynamics of Bitcoin experienced considerable shifts, preparing the ground for crucial storylines in 2025.

Bitcoin ETF Inflows and Market Influence

A significant milestone in the blending of cryptocurrency with conventional finance occurred with the introduction of spot Bitcoin exchange-traded funds (ETFs) in January 2024. BlackRock’s iShares Bitcoin Trust (IBIT) particularly excelled, drawing in close to $38 billion in net inflows within its initial year, making it the most successful ETF launch in history.

Notably, IBIT’s inflows surpassed those of established funds such as the Invesco QQQ Trust (QQQ), which tracks the Nasdaq-100 Index. By the midpoint of 2024, IBIT had accumulated roughly $18.97 billion in flows since the beginning of the year, slightly exceeding QQQ’s $18.90 billion.

Historically, ETFs witness modest initial inflows, with substantial growth materializing as investors become more comfortable and familiar with these instruments. Considering this trend, the strong early performance of Bitcoin ETFs in 2024 suggests the potential for even wider acceptance and increased capital inflows in 2025.

Favorable Macroeconomic Conditions: Interest Rate Reductions

The macroeconomic landscape in late 2024 offered a supportive environment for Bitcoin and other higher-risk assets. During the final quarter, the Federal Reserve implemented four distinct interest rate cuts, collectively decreasing rates by 1%. This loosening of monetary policy, aimed at managing inflation, is expected to persist into 2025. It should boost the appeal of riskier assets like Bitcoin by diminishing the opportunity cost of holding investments that don’t generate yield.

Institutional Adoption: Corporate and Government Interest

The year 2024 saw a transition from speculation driven by individual investors to considerable institutional investment in Bitcoin. Under the leadership of Michael Saylor, MicroStrategy considerably increased its Bitcoin holdings, acquiring around 258,320 BTC for $22.07 billion over the year, achieving a 74.3% return on these investments.

This assertive accumulation strategy solidified MicroStrategy’s standing as a leading corporate Bitcoin holder and illustrated the potential profitability of such ventures. This could inspire other corporations to consider similar allocations in 2025.

On the governmental side, President-elect Donald Trump’s administration has indicated a favorable stance towards crypto, with discussions about creating a Strategic Bitcoin Reserve via executive action. While the specifics and practicality of such a reserve are being debated, the U.S. government’s mere consideration of Bitcoin as a strategic asset might encourage other nations to explore incorporating Bitcoin into their national reserves, further legitimizing and stabilizing the cryptocurrency market.

In Conclusion

The combination of successful Bitcoin ETF launches, beneficial macroeconomic policies, and heightened institutional interest emphasizes a transformative period for Bitcoin. As 2025 progresses, these narratives are set to propel Bitcoin’s development from a speculative asset towards a mainstream financial tool, attracting a broader range of investors and strengthening its position within the global financial system.

Bitcoin: A Unique Hedge Against Uncertainty?

In conventional finance, “risk-off” assets are those investors turn to during times of economic instability or market unpredictability. These assets are seen as safe havens, protecting capital when riskier investments decline. Government bonds and gold are prime examples of this category due to their relative stability and backing by sovereign entities.

Government bonds are debt instruments issued by a nation’s government. They promise regular interest payments and the return of the initial investment upon maturity. Their low risk of default and predictable returns make them attractive during market downturns. Similarly, gold has served as a store of value for thousands of years. Valued for its scarcity and inherent worth, it often maintains or increases in value during financial crises.

Recent analyses, notably from ARK Invest, suggest that Bitcoin is evolving into an asset that performs well during risk-off periods, demonstrating qualities that may offer investors safety during turbulent times. Key observations include:

- Inherent Qualities for Risk-Off Scenarios: Bitcoin offers financial autonomy, reduces the risk of relying on intermediaries, and improves transparency. Its decentralized nature ensures no single entity controls it, lessening risks linked to centralized financial systems.

- Superior Attributes Compared to Traditional Assets: Bitcoin’s decentralization, finite supply, and enhanced transferability, liquidity, and accessibility surpass those of bonds, gold, and physical cash. These features enable seamless global transactions and make Bitcoin a versatile asset in the digital age.

- Outperforming Traditional Assets: Bitcoin has generated an average annual return of 60% over the last seven years, considerably exceeding the average 7% returns from bonds and other major assets. Investors holding Bitcoin for five years have consistently seen profits, whereas bonds, gold, and short-term U.S. Treasuries have experienced a 99% loss in purchasing power over the past decade.

- Resilience Across Varying Interest Rate Environments: Bitcoin’s price appreciation has continued through different interest rate scenarios, indicating its strength and potential as a safeguard against monetary policy changes.

- Performance During Periods of Uncertainty: During recent financial stresses, such as failures of regional banks, Bitcoin’s price increased by over 40%, demonstrating its potential as a safe-haven asset.

- Low Correlation with Other Asset Classes: Between 2018 and 2023, Bitcoin’s correlation with bonds was only 0.26, compared to a 0.46 correlation between bonds and gold. This low correlation suggests Bitcoin can improve portfolio diversification.

- Potential to Disrupt the Safe-Haven Asset Market: With a current value of around $1.3 trillion, Bitcoin represents a small portion of the $130 trillion fixed-income market, indicating significant potential for growth as it becomes more accepted as a risk-off asset.

While Bitcoin’s past volatility has led many to categorize it as a “risk-on” asset, its increasing maturity and the characteristics mentioned above are changing perceptions. As global economic conditions change, Bitcoin’s role in investment portfolios will likely expand, potentially reshaping traditional asset allocation strategies.

Crypto Stocks to Monitor in 2025

Crypto companies made a significant impact on Wall Street in 2024, becoming some of the highest gainers on an annualized basis. Numerous companies are planning to become publicly traded in 2025, and some may even exceed the market value of traditional financial institutions.

Crypto Companies Potentially Going Public in 2025

Analysts predict that 2025 could be the “Year of the Crypto IPO,” with major firms preparing for their initial public offerings (IPOs). Notable companies expected to go public include:

- Circle: The issuer of the USDC stablecoin has announced intentions to move its headquarters to New York City ahead of its anticipated IPO.

- Kraken: This cryptocurrency exchange is among the firms expected to conduct an IPO in 2025.

- Anchorage Digital: A platform for digital assets is anticipated to enter the public market.

- Chainalysis: A blockchain data platform is expected to go public.

- Figure: A financial technology company is anticipated to launch an IPO.

Coinbase Potentially Surpassing Charles Schwab

Given the rapidly increasing assets under Coinbase’s management, many believe it could overtake Charles Schwab as the world’s largest brokerage in 2025. This potential shift is attributed to Coinbase’s diverse income streams, including its Ethereum Layer 2 network, Base, staking services, and stablecoin operations.

Consequences of These Developments:

The anticipated public listings and shifts in market valuation carry several implications:

- Enhanced Legitimacy: The entry of significant crypto companies into public markets increases the credibility of the cryptocurrency industry, potentially attracting previously hesitant investors.

- Wider Investor Access: Public listings enable a broader spectrum of investors to gain exposure to the crypto sector through conventional investment vehicles, such as stocks, without directly purchasing cryptocurrencies.

- Market Dynamics: Including crypto companies like MicroStrategy and Block in major indices such as the S&P 500 could increase investment from index funds, ETFs, and general investors, further integrating crypto into mainstream finance.

- Competitive Landscape: As crypto firms increase in valuation and influence, traditional financial institutions may face greater competition, potentially leading to innovations and adaptations within the wider financial sector.

These developments indicate a maturation of the cryptocurrency industry, signaling its transition from a niche market to a significant part of the global financial ecosystem.

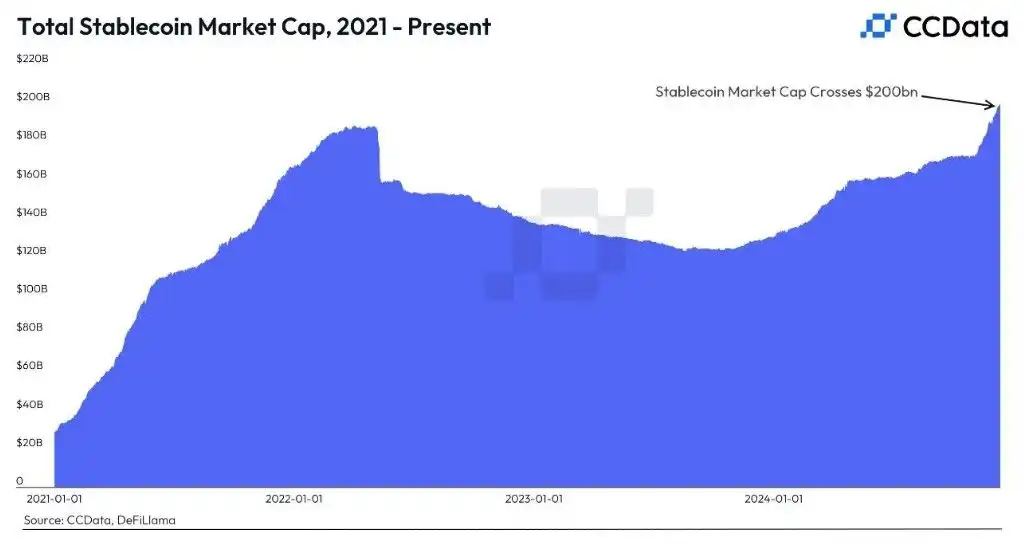

Stablecoin Market Could Double in 2025

The stablecoin market experienced considerable growth in 2024, with its market capitalization reaching the $200 billion mark. This expansion is projected to continue, with forecasts suggesting the market could double in 2025 as adoption accelerates.

Growth in 2024 and Forecasts for 2025

In 2024, the stablecoin market’s capitalization grew to $200 billion, reflecting increased adoption and integration into various financial systems. This growth is due to the increasing demand for digital assets offering the stability of traditional fiat currencies, facilitating smooth transactions and acting as a buffer against the volatility typically associated with cryptocurrencies.

Industry analysts predict that the stablecoin market could double in size by the end of 2025. This forecast is based on several factors, including wider acceptance of digital payments, advancements in blockchain technology, and greater regulatory clarity, all contributing to a more favorable environment for stablecoin use.

Stablecoins and U.S. Dollar Dominance

Contrary to earlier concerns that the rise of stablecoins might weaken the U.S. dollar’s dominance, recent analyses from Reuters indicate that stablecoins could reinforce it. Stablecoins pegged to the U.S. dollar facilitate cross-border transactions denominated in dollars, enhancing the dollar’s utility in the global financial system. This development highlights the dollar’s adaptability within the evolving digital economy.

Implications of Stablecoin Growth

- Improved Financial Inclusion: Stablecoins provide access to financial services for individuals in regions with limited banking infrastructure, encouraging greater economic participation.

- Efficiency in Transactions: Using stablecoins can streamline international payments, reducing costs and settlement times compared to traditional banking systems.

- Regulatory Considerations: As the stablecoin market expands, regulatory bodies are increasingly focusing on establishing frameworks to ensure financial stability and prevent illicit activities.

- Integration with Traditional Finance: Financial institutions’ growing acceptance of stablecoins indicates a convergence between conventional finance and digital assets, potentially leading to innovative financial products and services.

In summary, the stablecoin market’s significant growth in 2024 and projected expansion in 2025 underscore its essential role in the digital transformation of the financial landscape. Moreover, contrary to previous worries, the increasing use of dollar-pegged stablecoins may strengthen the U.S. dollar’s dominance in global finance.

RWAs: A Key Crypto Narrative in 2025

The tokenization of real-world assets (RWAs) has gained considerable traction. Digitizing assets such as private credit, U.S. debt, commodities, and stocks is transforming conventional finance, improving liquidity, transparency, and access within the financial markets.

Recent Expansion and Future Projections

Bitwise noted that the tokenized RWA market grew from under $2 billion three years ago to approximately $13.7 billion. With increasing adoption and technological progress, Bitwise anticipates this market will reach $50 billion by 2025.

Venture capital firm ParaFi predicts the RWA market could expand to $2 trillion by 2030, while the Global Financial Markets Association (GFMA) estimates a potential market value of $16 trillion by the same year.

Factors Driving Growth

Several key factors are contributing to the rapid growth of the tokenized RWA market:

- Superior Asset Management: Tokenization offers immediate settlement, lower costs compared to traditional securitization, and continuous liquidity. It also enhances transparency and provides access to diverse asset classes.

- Institutional Adoption: Major financial institutions are increasingly embracing tokenized RWAs. For example, BlackRock’s USD Institutional Digital Liquidity Fund, tokenized in partnership with Securitize on Ethereum, now holds $515 million in assets, making it the largest tokenized U.S. Treasuries fund.

- Technological Advancements: The development of blockchain technology and smart contracts facilitates the efficient and secure tokenization of assets, attracting both investors and issuers.

Implications for the Financial Ecosystem

The growth of tokenized RWAs has several significant implications:

- Enhanced Liquidity: Tokenization enables fractional ownership, allowing investors to buy and sell portions of assets, thereby increasing market liquidity.

- Broadened Access: Investors can access a wider array of asset classes that were previously illiquid or difficult to invest in, democratizing investment opportunities.

- Operational Efficiency: Automating processes through smart contracts reduces administrative burdens and costs associated with asset management and transactions.

- Regulatory Considerations: As the market grows, regulatory frameworks are evolving to address challenges related to security, compliance, and investor protection.

In Conclusion

The tokenization of real-world assets (RWAs) is reshaping the financial landscape, offering improved efficiency, accessibility, and liquidity. Projections indicate substantial growth by 2025 and beyond, and tokenized RWAs are positioned to become a cornerstone of modern finance, attracting both institutional and retail investors seeking innovative investment opportunities.

AI Agents Will Grow Significantly

In 2024, AI agents emerged as a prominent theme within cryptocurrency, driven by platforms like Virtuals and ai16z, which developed user-friendly solutions for deploying AI agents. These specialized AI bots are designed to understand user intentions and perform complex tasks, simplifying processes across various applications.

Expansion of AI Agents in 2025

The integration of AI agents into the crypto ecosystem is expected to broaden considerably in 2025, extending beyond decentralized finance (DeFi) into various sectors:

- Social Media Influencers: AI agents like AIXBT are transforming platforms such as Crypto Twitter by providing up-to-the-minute market intelligence and trend analysis, improving information sharing.

- Financial Analysts: AI-powered analytical tools are offering investors sophisticated insights, enabling more informed decision-making in the volatile crypto markets.

- Entertainment and Interactive Applications: AI agents are being used to create engaging content and interactive experiences, enhancing user involvement within the crypto community.

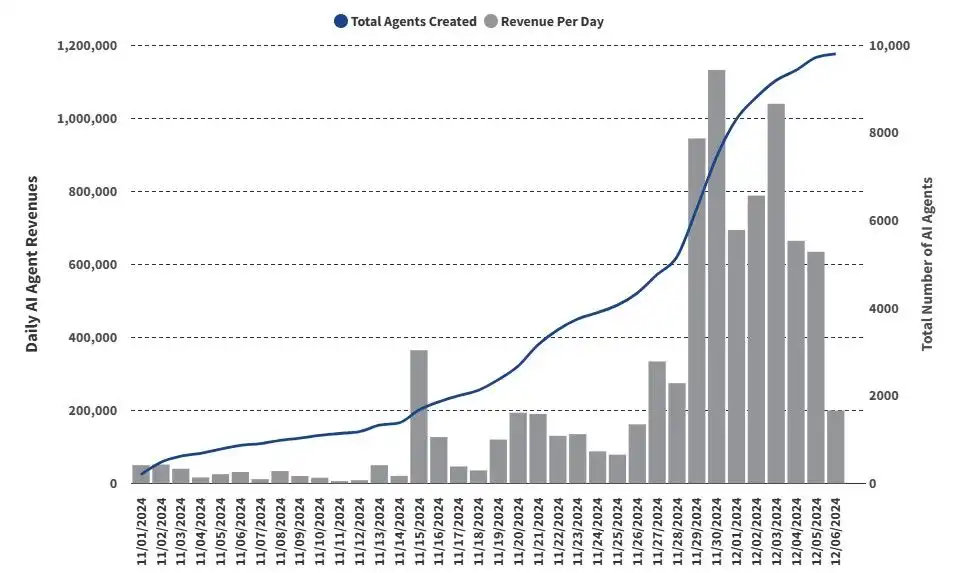

The Increase in AI Agents

As the development of AI agents becomes more accessible and affordable, their numbers are expected to surge. Currently, there are over 10,000 AI agents with millions of daily users. Projections suggest that by the end of 2025, the number of AI agents could reach one million, indicating widespread adoption across various platforms.

The Emergence of AI Meme Coins

The merging of AI and meme culture has created AI-themed meme coins, adding a new dimension to the crypto market. The success of projects like Terminal of Truths and the $GOAT meme coin has inspired a wave of similar initiatives, blending humor with advanced AI functionalities. This trend is expected to gain traction in 2025, attracting both investors and enthusiasts.

Implications for the Crypto Ecosystem

The rapid growth of AI agents and AI-themed meme coins signifies a transformative shift in the crypto landscape:

- Enhanced Accessibility: User-friendly platforms empower individuals without technical expertise to develop complex AI tools, democratizing innovation within the crypto space.

- Diversification of Applications: Expanding AI agents into various sectors fosters a more interconnected and versatile ecosystem, promoting broader adoption.

- Market Dynamics: The rise of AI meme coins introduces new investment opportunities and challenges, influencing market sentiment and investor behavior.

In Conclusion

The integration of AI agents and the emergence of AI-themed meme coins are poised to play a crucial role in shaping the crypto narrative in 2025, driving innovation and expanding the boundaries of the digital asset landscape.

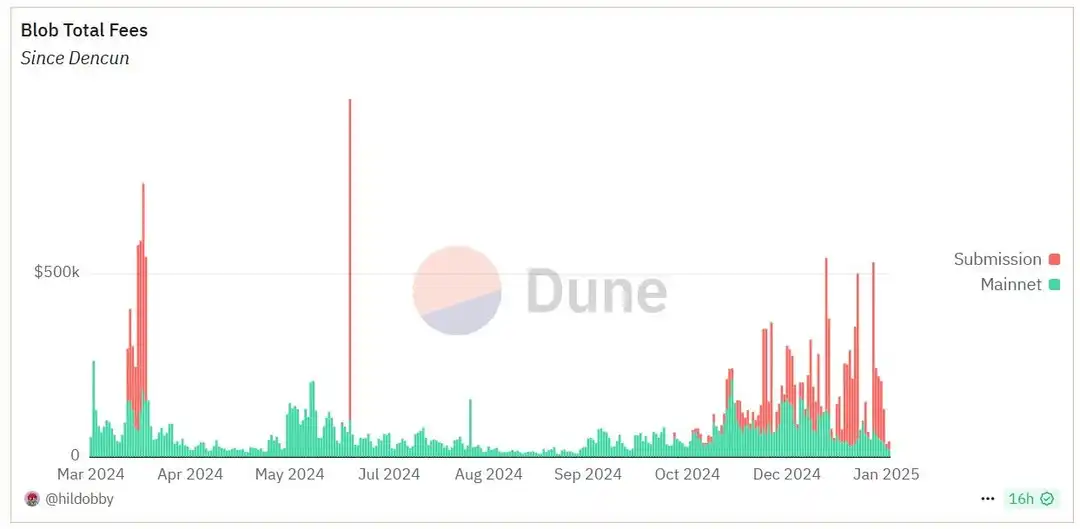

Ethereum Blob Fee Market Could Exceed $1 Billion

EIP-4844, known as Proto-Danksharding, has significantly improved Ethereum’s scalability, introducing “blob-carrying transactions” to optimize data storage for Layer 2 (L2) networks. This development also introduced a separate fee market for these transactions, the “blob gas market.”

Understanding EIP-4844 and Blob-Carrying Transactions

EIP-4844, or Proto-Danksharding, was implemented to enhance Ethereum’s scalability by enabling a new type of transaction capable of carrying large amounts of data, known as “blobs.” These blobs are temporarily stored in Ethereum’s beacon nodes, allowing L2 solutions to post data without competing with Layer 1 (L1) transactions for gas fees. This separation leads to lower costs and greater efficiency for L2 operations.

Dual Fee Markets and Base Fee Burn Mechanism

With the introduction of blob-carrying transactions, Ethereum now operates with two simultaneous fee markets:

- Layer 1 Fee Market: Handles traditional transactions and smart contract executions.

- Blob Gas Market: Dedicated to L2 transactions utilizing blob data.

Both markets incorporate the base fee burn mechanism established by EIP-1559. In this mechanism, a portion of transaction fees is destroyed, reducing the overall supply of ETH and potentially increasing its value.

Current Usage and ETH Burn Projections

Since November 2024, validators have posted over 20,000 blobs on Ethereum daily. If this trend continues or accelerates, projections indicate that blob fees could destroy over $1 billion worth of ETH in 2025, representing a significant milestone in Ethereum’s evolving security and economic model.

Factors Driving Blob Space Expansion in 2025

Several key factors are expected to drive the increased use of blob space in 2025:

- Rapid L2 Adoption: Transaction volumes on Ethereum L2s are growing at an annualized rate exceeding 300% as users move to lower-cost, high-throughput environments for DeFi, gaming, and social applications. The increasing number of consumer-facing decentralized applications (DApps) on L2s will significantly increase the demand for blob space as more transactions are finalized on Ethereum.

- Rollup Optimizations: Advancements in rollup technology, such as improved data compression and reduced costs for posting data to blob space, will encourage L2s to store more transaction data on Ethereum, enabling higher throughput without compromising decentralization.

- Introduction of High-Fee Use Cases: The rise of enterprise-grade applications, zk-rollup-powered financial solutions, and tokenized real-world assets will drive high-value transactions, prioritizing security and immutability, and increasing the willingness to pay blob space fees.

Implications for Ethereum’s Ecosystem

The growth of the blob gas market has several implications:

- Improved Scalability: By offloading L2 data storage from the main Ethereum chain, the network can handle more transactions without congestion, improving user experience.

- Economic Impact: Burning ETH through blob fees reduces supply, potentially putting upward pressure on its price, benefiting holders and network participants.

- Security Considerations: The increased use of blob space highlights the need for ongoing monitoring to ensure the network’s consensus security remains robust amidst higher data throughput.

In Conclusion

The implementation of EIP-4844 and the subsequent development of the blob gas market represent significant advancements in Ethereum’s scalability and economic model. As Layer 2 adoption accelerates and new use cases emerge, the utilization of blob space is poised for substantial growth in 2025, reinforcing Ethereum’s position as a leading platform for decentralized applications.

Closing Thoughts

Reflecting on the transformative trends shaping the cryptocurrency landscape, it’s clear that 2025 holds considerable potential. However, it’s vital to approach this evolving market with a measured perspective, balancing optimism with caution.

Key Takeaways:

- Innovation and Growth: The rapid progress in AI agents, the expansion of Ethereum’s Layer 2 solutions, and the increasing tokenization of real-world assets emphasize the dynamic nature of the crypto ecosystem.

- Mainstream Adoption: The incorporation of crypto into traditional financial systems, illustrated by institutional investments and the rise of stablecoins, suggests a wider acceptance and validation of digital assets.

- Regulatory Developments: Anticipated regulatory shifts, particularly under the current U.S. administration, are set to influence the direction of the crypto market, potentially presenting both opportunities and challenges. This highlights the need for careful consideration amid rapid market changes.

Guidelines for Investors:

- Conduct Thorough Research: Before making any investment decisions, ensure you have a comprehensive understanding of the assets and technologies involved.

- Avoid Excessive Leverage: Using high leverage can amplify both profits and losses. To minimize potential risks, it’s advisable to use conservative leverage.

- Diversify Investments: Avoid concentrating your portfolio on a single asset or sector. Diversification can help spread risk and improve potential returns.

- Stay Informed: The crypto market is highly dynamic. Regularly update yourself on the latest developments, regulatory changes, and market trends.

In Conclusion

While the cryptocurrency market offers unprecedented opportunities, it’s essential to approach it with a disciplined and informed mindset. By balancing optimism with caution, investors can navigate this evolving landscape more effectively, capitalizing on its potential while protecting against inherent risks.

Ready to start your Bitcoin journey? Sign up for OKX, Binance, or Bitget today and take your first step into the world of cryptocurrency!