OKX stands out as a trailblazer in Web3 innovation and ranks among the top cryptocurrency exchanges globally. It supports a vast selection of altcoins and provides multiple payment options, including Visa, MasterCard, bank transfers, and Apple Pay, making it highly accessible. Known for its advanced trading technology, extensive range of assets, and some of the lowest fees in the industry, OKX has quickly become one of the fastest-growing platforms, offering a professional-grade experience for traders of all levels.

Getting Started With OKX Trading

The first step to using any centralized exchange like OKX is creating an account using credentials like email or phone number. Once registered, crypto exchanges also demand users comply with their KYC (Know Your Customer) standards.

Once registered, you can deposit funds through fiat or crypto channels and use them to trade cryptocurrencies, participate in DeFi, or buy NFTs on the exchange. Let’s get into these steps in detail.

Account Registration

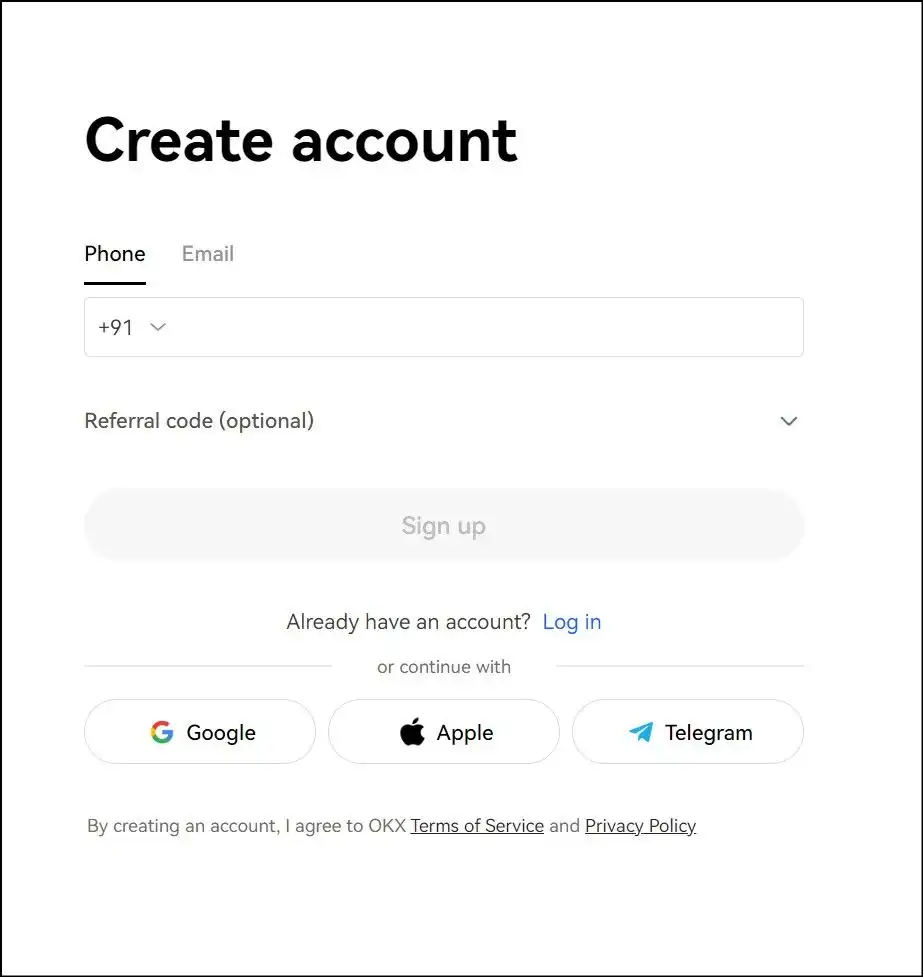

Registering an account with OKX is an essential first step to using the exchange. You need a secure email or a phone number to create an account on OKX.

Here are the steps to follow:

- Singing up: Find the ‘Sign Up’ button on the exchange homepage at the bar on the top of the screen.

- Fill in the details: Sign up with a secure email address or phone number. You can also sign up with your Google or Apple account directly.

- Terms of Use: OKX assumes you accept their terms of use when you sign up. Therefore, make sure to read it thoroughly before confirming your details.

- Complete the verification: OKX will send a verification code to your registered email/phone. Use the code to complete the signing-up process.

- Specify your country: OKX will ask for your residence country. Make sure you provide the same country as your KYC verification details.

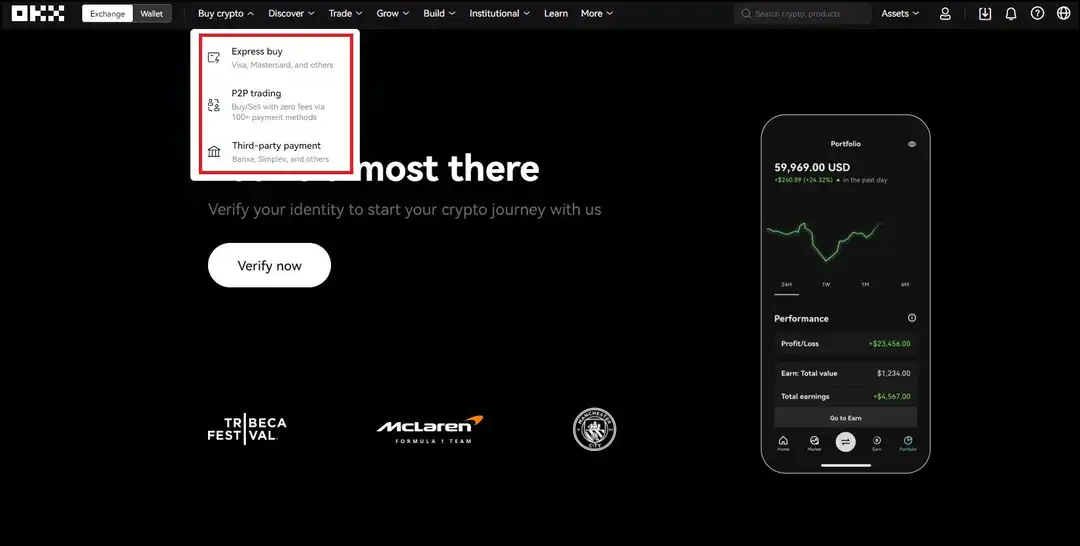

Verify Your Identity

Like every other major centralized cryptocurrency exchange, OKX requires you to complete KYC requirements to unlock all their exchange features and services. You may identify your account as:

- Individual – Provide personal identity information.

- Institution – Provide legal documents of your institution’s incorporation and operations.

The individual verification process entails providing a national ID, a selfie, and a Proof of Address (if applicable). After completing the process in just five minutes, I had a smooth experience verifying my identity. Here are some tips to ensure quick verification:

- Use your phone to verify; you don’t have to install the OKX app.

- Ensure sufficient lighting in the room where you take selfies and ID pictures.

- Use a standard ID, like your driver’s license.

Depositing Funds

You need funds to access any service or trade on OKX. There are multiple deposit options to choose between; they span both fiat and crypto pathways. Let’s explore them one by one.

Buy Crypto With Fiat

Find the ‘Buy crypto’ tab on the bar at the top. The drop-down menu lists three fiat options to buy crypto:

- Express buy – This option lets you buy (or sell) select cryptocurrencies with fiat currency. Express Buy supports over 90 fiat currencies and prominent payment channels like Visa, Mastercard, and Apple Pay.

- P2P trading – OKX connects you with crypto buyers and sellers over fiat channels and mediates the transaction. Here, you pay the party directly. Traders generally use P2P trading with stablecoins.

- Third-party payment – Institutions like Banxa and Xanpool support cryptocurrency orders on OKX. Please note that these are external parties beyond OKX’s control.

Please note that fiat channels for buying cryptocurrencies are only supported in some places, so you must check if they are in your country. Select the most comfortable option and follow the corresponding payment gateways to complete your order.

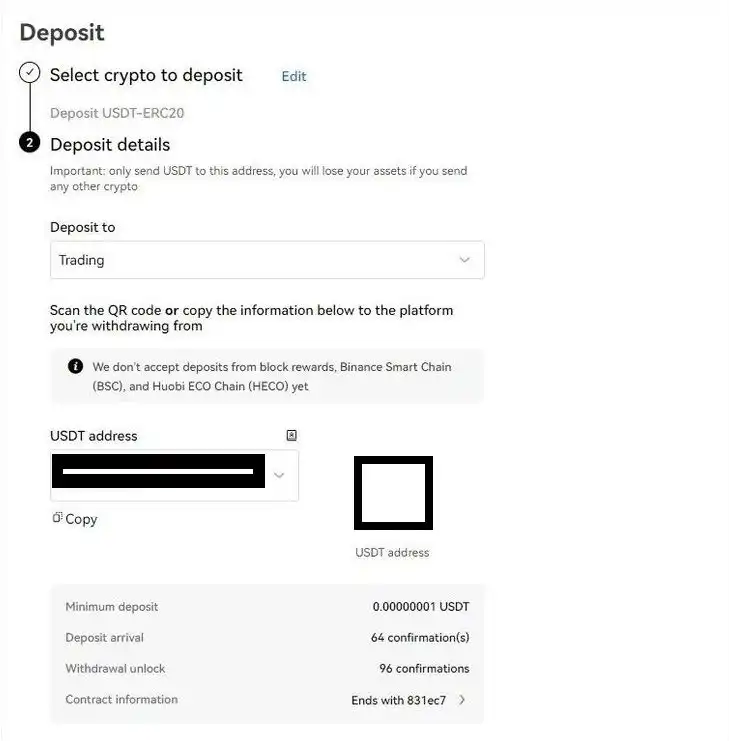

Make On-Chain Crypto Deposits

The exchange also supports on-chain deposits if you already have some cryptocurrencies in an on-chain address that you want to move to OKX. Find the ‘Assets’ tab on the top-right. From the drop-down menu, select ‘Deposit’ to reach the deposits window.

Follow these steps to make the deposit:

- Select the cryptocurrency you want to deposit.

- Select the network where you will deposit the cryptocurrency from, which is the network where your funds currently reside, and then click next.

- Select the desired OKX account. The ‘Trading’ account is used for spot trading, while the ‘Funding’ account is dedicated to products like OKX Earn.

- Send the funds to the address provided by the exchange and wait for confirmation. The selected OKX account will reflect the funds momentarily.

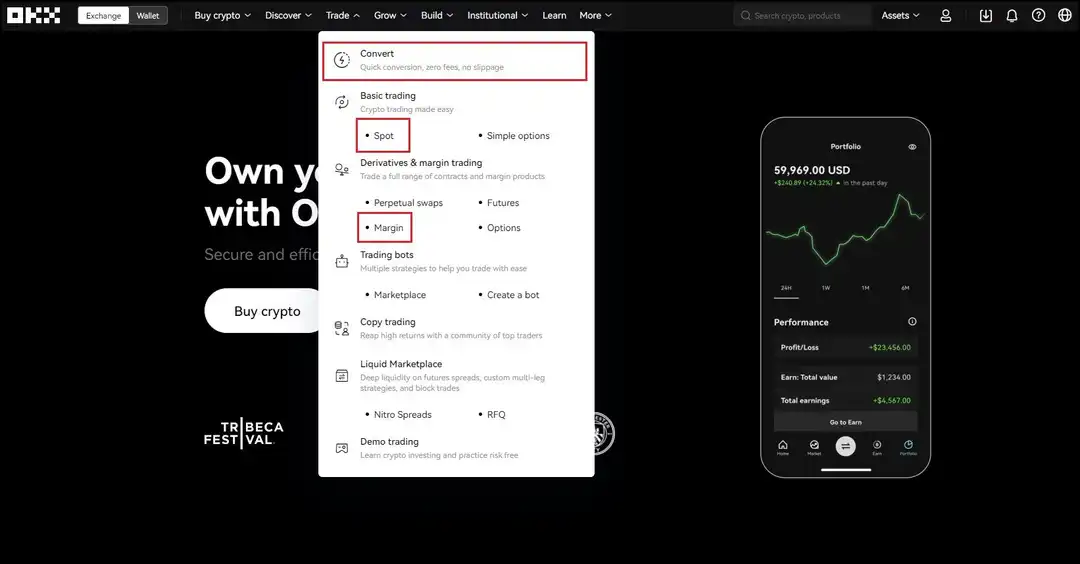

Place Your First Trade

Now that you have some funds in your account, you can begin trading cryptocurrencies. Find the ‘Trade’ tab from the bar at the top. The drop-down menu lists several beginner and advanced trading options. Let’s discuss a few basic trading strategies to get you up to speed.

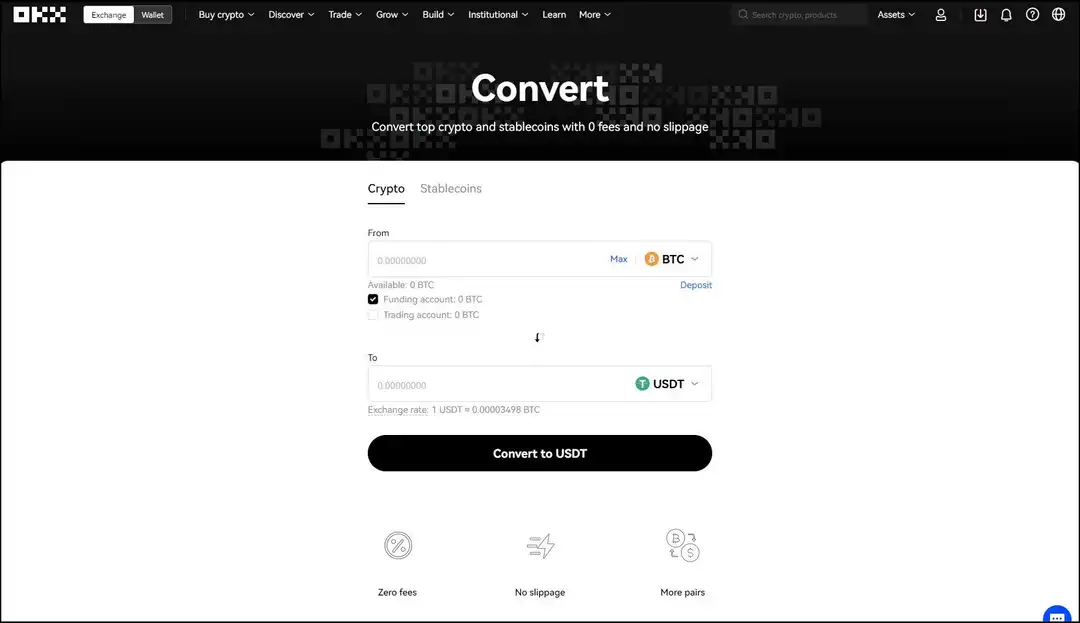

OKX Convert

Convert is a straightforward feature for folks who want to swap one cryptocurrency for another. Convert is most conventionally used for exchanging stablecoins for coins like BTC, ETH, or DOGE. OKX Convert swaps the selected cryptocurrencies instantly and at market price, circumventing advanced features offered in the spot trading portal.

The Convert feature is great for beginner traders or any who doesn’t need to access a charting interface to perform technical analysis.

Spot Trading

Spot is the financial market where assets are traded for instant delivery and settlement. Access the spot market on OKX from the ‘Trade’ tab at the top bar.

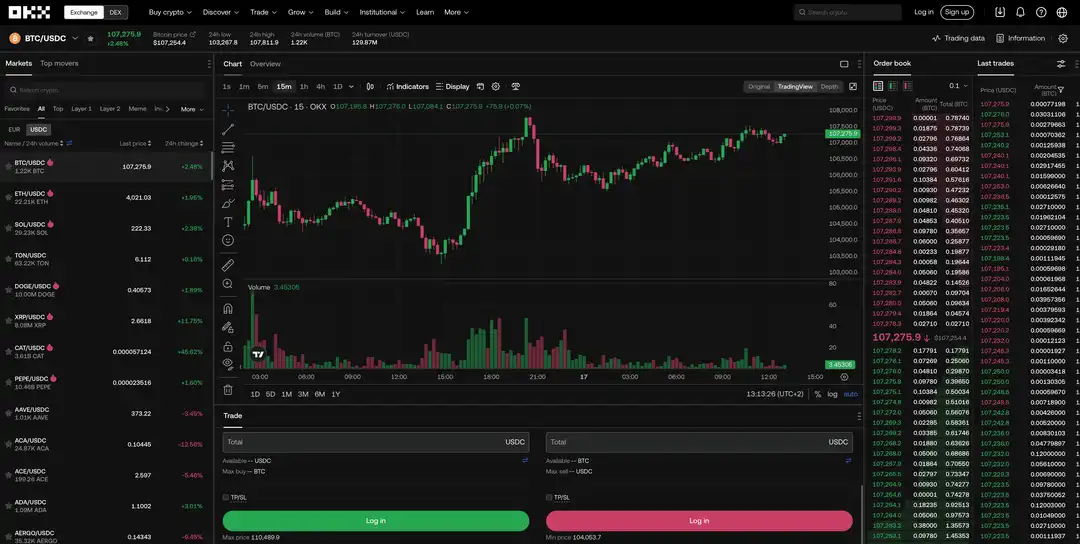

This is what the Spot trading screen looks like on the OKX exchange. Let’s break it down to understand its several elements:

- Header – The row above the price chart summarizes essential details about the asset, like the trading pair, the current price, highs and lows. You can observe the BTC/USDT pair in the picture above.

- Chart – The candlestick chart displays the price history of the selected pair. Adjust the time frame for a broader/narrower view based on your trading strategy, and use the available drawing tools and indicators to deduce price patterns. TradingView provides the price charts on the OKX exchange.

- Order book – The order book is on the price chart’s immediate right. It displays volumes of buy or sell orders from other traders at different price levels. The order book summarizes all the trader’s sentiment, known as market depth.

- Order window – You can place buy or sell orders on the trading window below the price chart. A BTC/USDT buy order purchases BTC for USDT and vice versa. OKX supports several crypto-stablecoin or crypto-crypto trading pairs.

Order Types

In the Spot market, traders have the flexibility to place buy or sell orders at their chosen prices, forming a collective order book. Orders remain pending until their specified price aligns with the prevailing market rate. At this stage, the exchange pairs a buyer with a seller (or vice versa) to carry out the trade.

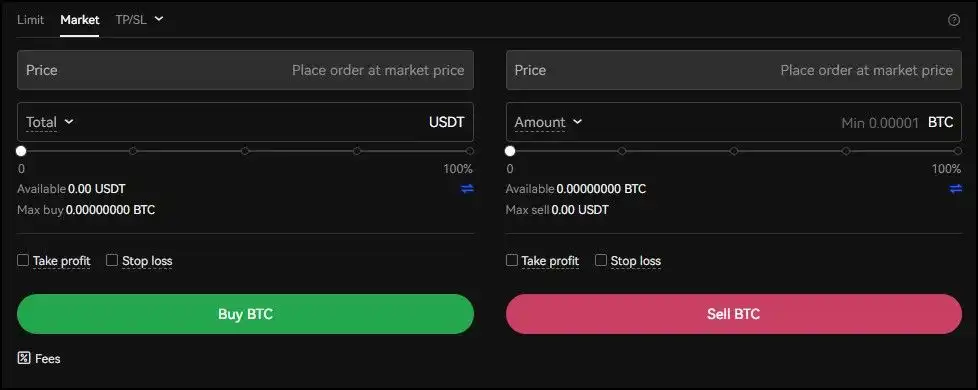

Traders can customize their orders to execute only when certain conditions about the trade are met. The exchange holds the order for the traders, so they don’t have to be online to manage them. There are three types of orders available on OKX:

- Market – Akin to the convert feature, market orders conduct immediate swaps at the current market price.

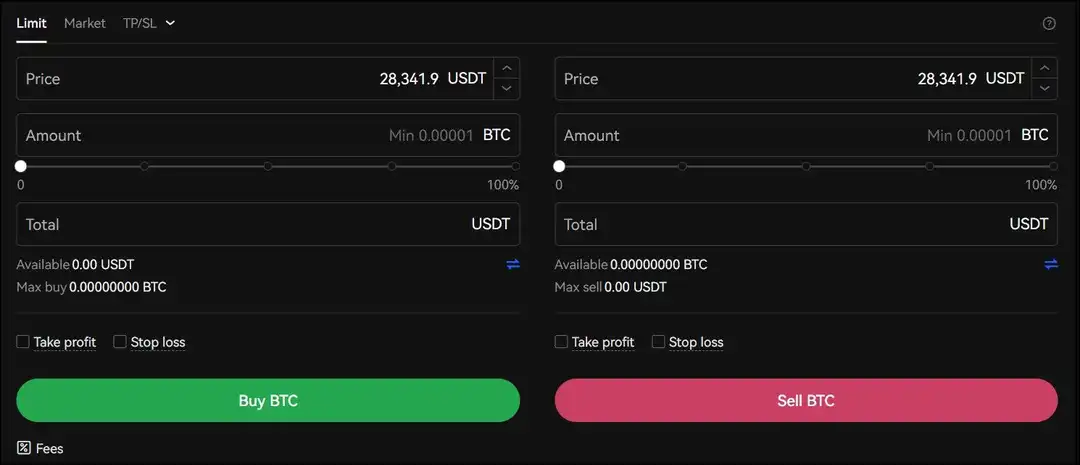

- Limit orders – Traders set their desired amount and price at which they want to execute trades. The order is on hold until the market meets those conditions.

- Stop orders – It offers further order customizability by offering secondary conditions the market must meet to open the orders.

- Limit orders – In a limit order, the trader specifies the amount of assets and the price they wish to buy. Placing the order locks the necessary funds, and the order executes only when the market meets the specified conditions.

Stop Order Types

A stop order lets a trader open a spot position only when the market meets a particular condition about the asset price. Stop orders are convenient when you have a bullish or bearish sentiment over an asset only when the price hits a threshold. OKX supports the following stop orders:

TPSL (Take Profit and Stop Loss) Orders – A TPSL order asks the trader to set a trigger price, an order price, and an order amount. The exchange opens the order only when the asset price hits the trigger price. Once triggered, the TPSL order behaves like a limit order. OKX also lets users set the limit at market, meaning the order executes at the best price after getting triggered.

OKX also lets users set TPSL orders as conditional or OCO (One Cancels the Other). An OCO order enables the trader to specify two positions simultaneously. The idea is to place an order if the market moves in the trader’s direction favourably and to cut losses otherwise.

The speciality of an OCO order is that once it executes an order in one direction, it automatically cancels the order in the other direction. Traders need to enter the following values here:

- Amount – The amount of assets you wish to trade.

- TP trigger price – The trigger price to open the take profit order.

- TP price – The price at which to take profit (you can also set it at market).

- SL trigger price – The trigger price for the stop loss order.

- SL price – The price at which you want to cut losses (you can also set it at market price).

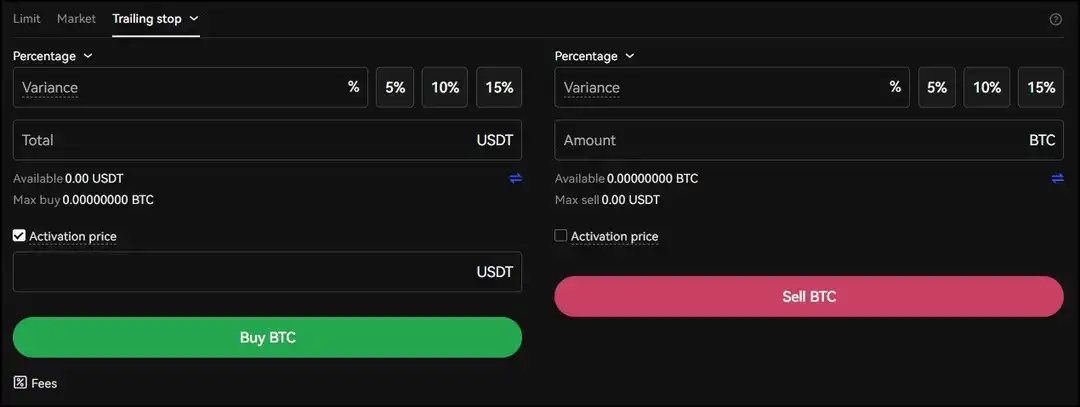

Trailing Stop – A trailing stop order lets you place an order that ‘trails’ the asset price when it is trending in a favourable direction and exits the position of the trend changes direction. The order consists of three values — activation price, variance, and amount.

Margin Trading

Margin trading involves investors trading with borrowed funds from the exchange, allowing them to trade with more capital than they have on hand, creating a high-risk, high-reward scenario. The term “Margin” pertains to the collateral the trader provides, while “leverage” describes the increased buying power they gain.

The process of margin trading begins with the trader depositing collateral into their margin account with the exchange. Depending on the broker’s terms, the trader can borrow funds from the exchange, typically at multiples of their deposited margin, ranging from 2x to a highly risky 100x. To safeguard its loan, the exchange retains the right to close the trader’s open positions and recover its funds if the market moves unfavourably for the trader; this is referred to as a margin call.

For example, a 2x leveraged position triggers a margin call if the value of the trader’s margin account drops by half, considerably riskier than a spot position that remains open until the asset’s value becomes zero. Conversely, if the market moves in the trader’s favour, they can double their profit after repaying the exchange for the leverage and any accrued interest. OKX offers cross and isolated margin options with up to 10x leverage. The leverage may differ with every asset. Let’s understand cross and isolated margins:

Cross Margin: Cross margin combines collateral and various leveraged positions across multiple cryptocurrencies into a unified pool. Traders are limited to a single cross-margin account, with the account value representing the total worth of all margin positions held within it. In the event of a margin call, all positions within the account are liquidated. On the other hand, diversifying the portfolio can assist in risk management, as an appreciating asset can offset the volatility of a declining one. In cross-margin trading, leverage traders can open positions up to 10 times larger than the collateral they provide.

Isolated Margin: Isolated margin resembles cross margin in many ways, with the key distinction being that it confines trading to a single asset type. Traders have the flexibility to create multiple isolated margin accounts for different asset categories, each having distinct collateral and margin constraints. On OKX, traders can initiate positions up to 10 times the amount of collateral within an isolated margin account.

Warning ⚠️: Trading with Margin is high risk and recommended for experienced and professional traders only. Be sure to understand the dangers of leverage before utilizing this product.

OKX Trading Key Features

OKX offers several intuitive features and security guarantees, equating to an experience ideal for polished and novice traders. Some essential features are summarized here:

- Wide selection of cryptocurrencies – The exchange offers a wide range of cryptocurrencies for trading and lists new tokens frequently, providing traders with several trading options.

- Trading options – Apart from spot and margin trading, the exchange also supports futures and options, perpetual swaps, and several Earn products.

- Advanced trading tools – OKX provides seasoned traders with advanced technical analysis and trading tools.

- Security – OKX provides transparent Proof of Reserves and maintains 1:1 deposits to ensure adequate liquidity.

- DeFi Staking – OKX also offers staking services with funds in the user’s account.

- OKB Token – The OKX native token, OKB, offers its owners several security, financial, and utility services and passive earning services.

- NFT Marketplace – The exchange also hosts an NFT marketplace where users can buy well-known NFTs.

- User interface – The OKX exchange interface is simple for average users and offers the customizability experienced traders prefer.

Understanding OKX Fees

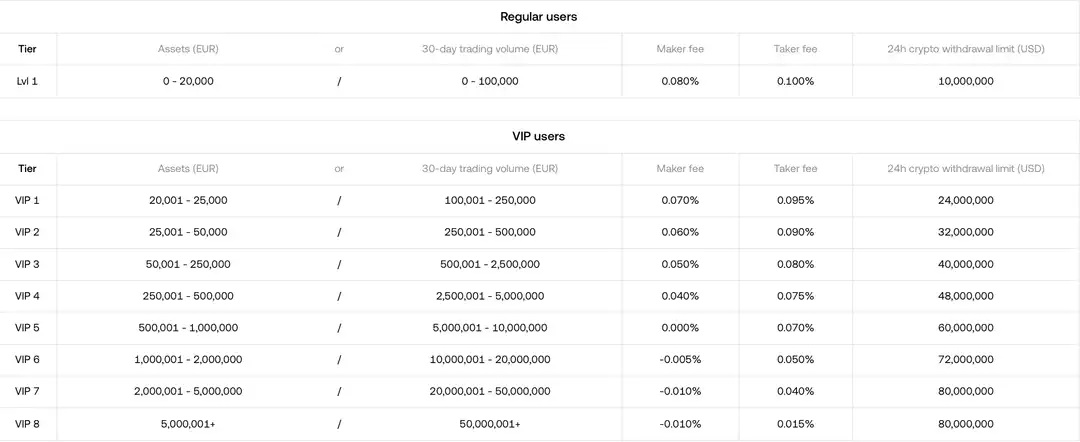

OKX charges some of the lowest fees in the industry. It adopts a tiered approach that depends on the number of OKB tokens the user owns. Holding more OKB promotes you to a higher tier and reduces trading fees. Here is a snapshot of the latest tiers at the time of writing. However, fees are subject to revisions, and I suggest you verify the latest value on the OKX Fees Page.

OKB Token

The OKB token is an ERC-20 token with a maximum supply of 300 million units. It is a utility token native to the OKX ecosystem and offers several benefits and discounts to its holders. Here is a summary of its benefits:

- Fee deduction – Exchange users can pay trading fees with the OKB token to benefit from up to 40% discount on trading fees.

- Access Jumpstart – OKX Jumpstart is a token sales platform where users can invest using the OKB token.

- Listing votings – Users can vote with OKB to have their favourite token listed on the exchange.

- External services – The OKB token unlocks several security, financial, and utility services from third parties.

- OKB Chain – The OKB Chain (OKBC) is a zkEVM layer-2 on Ethereum that deploys the OKB token as its settlement currency.

OKX Security and Trustworthiness

OKX boasts a robust security framework and has never fallen victim to any security breaches. It deploys several security measures at various levels, which are summarized below:

- Fund Storage – OKX holds 95% of its funds in offline cold wallets to protect them from attacks. The wallet access requires authorization from at least two security personnel. Therefore, the funds are stored in an acutely secure environment.

- OKX Risk Shield – OKX allocates a percentage of its earnings to an asset risk reserve fund.

- Mandatory 2FA – OKX mandates two-factor authentication, reducing the risk of user account hacks significantly.

- Secure Private Key Storage – OKX stores private keys in RAM instead of permanent memory for enhanced security.

- Emergency Backups – Multiple backup procedures adopted by OKX ensure optimum preparation for potential emergency scenarios.

As with any centralized financial service, individuals considering staking assets on OKX Earn or depositing assets on OKX accounts must exercise due diligence and clearly understand the associated risks.